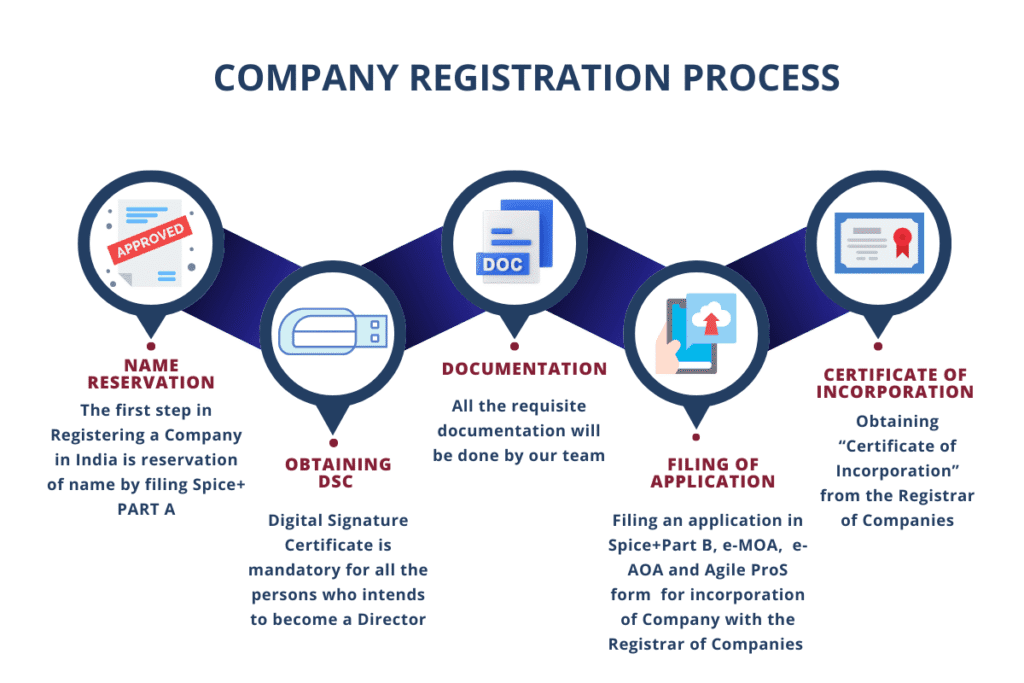

How to Register a Company in India

If you’re starting a business in India, registering your company is one of the most important foundational steps. A registered company gives your business a formal legal identity, helps in gaining trust among clients, and unlocks various government benefits. Whether you’re building a startup, offering services, or launching a product, registration ensures you are compliant […]